* All data is as of the close of Tuesday, November 11, 2014. Emphasis is on company fundamentals and financials rather than commentary.

Few may realize this, but the mail order catalog business has been around since the railroad was first laid across America. Sears was one of the first to see its potential to reach remote Midwestern settlers who made just one trip a week to the nearest town for supplies. and even then, the only products they had to choose from were just the ones the general store had in stock.

Thanks to the railroad and the miles of telegraph cable that lined its tracks, these isolated settlers were suddenly able to order products that would otherwise only be available in major cities, products that most settlers didn’t even know existed. they placed their orders by telegraph or simply sent a card with the correct boxes checked, and voila! within a week or two your items were delivered by train to the post office in your nearest city.

Nowadays, those heavy catalogs rarely reach homes through the mail like they used to. but the spirit of mail order is still alive and kicking. the only difference today is that instead of ordering products through a telegraph wire, shoppers place their orders through the internet by cable online.

oh, and there’s another big difference too… thanks to the speed of order processing and the volume of current buyers, catalog stock & Mail order houses have skyrocketed, as shown in the chart below that spans the economic recovery since early 2009.

where the broader market s&p 500 [black] index and spdr consumer discretionary etf (nyse: xly) have gained 200% and 325% respectively, the two largest catalog & Mail Order Houses – Amazon.com Inc. (nasdaq: amzn) [beige], and freedom interactive corporation (nasdaq: qvca) [purple] – have posted gains of 400% and 1,250% respectively. the third largest in the country, lands’ end, inc. (nasdaq: le) [orange], has been publicly traded only since March this year and thus has only grown by 30%. (What a small industry, where 30% in less than a year is considered mere.)

on an annualized basis, where the s&p 500 averages 35.29% and the xly averages 57.35%, lands’ end averages 45%, amazon averages 70.59%, while liberty averages 220.59% per year. year!

source: bigcharts.com

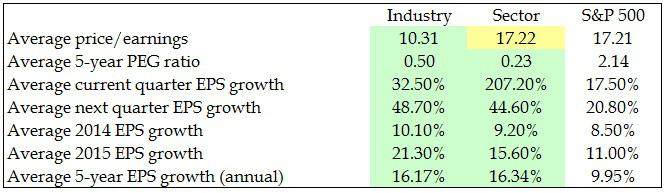

With the holiday gift-buying season just around the corner, investors may want to consider ordering some catalog & mail-order stocks, given huge future earnings growth projections as shown below, where green indicates outperformance while yellow denotes underperformance.

where the industry is seen to exceed the average earnings growth rate of the broader market by some 1.8 to 2.3 times in the immediate term and in 2015, its growth rate is expected to stabilize at a more sustainable rate of 1.6 times the rate of the general market in the next five years.

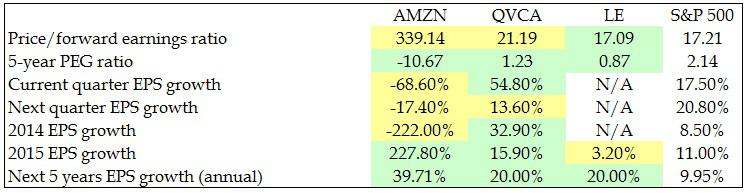

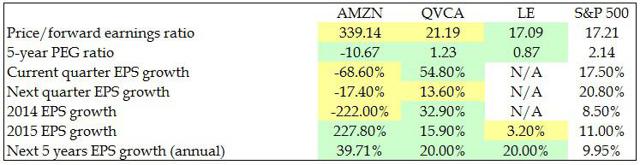

Coming a little closer, the three largest in the us. uu. Companies in the industry are expected to do a split in the immediate term, with Amazon’s earnings declining sharply this and the next few quarters, while Liberty’s earnings are split from very strong to very weak. Many are not surprised, given the huge dent Alibaba (NYSE: Baba) has made in the online marketing space. (by the way, alibaba is not among those being compared here as it is not a US company and belongs to the “specialty retail – other” industry).

However, in the longer term, both amazon and liberty are projected to outperform the broader market average earnings growth of 1.5 to 20 times the rate.

by lands’ end, while near-term earnings growth projections are not available, projections for 2015 and beyond are expected to improve from greatly underperforming to greatly outperforming.

However, there is more to considering earnings growth when evaluating a company as a potential investment. how do the three compare to each other in other metrics and which one makes the best investment?

We’re going to answer that by comparing your company’s fundamentals using the following format: a) financial comparisons, b) analyst estimates and recommendations, and c) ratings with the attached data table. As we compare each metric, the best performing company will appear shaded green, while the worst performing company will be shaded yellow, which will then be counted towards the final ranking.

a) financial comparisons

• Market Capitalization: While company size does not necessarily imply an advantage and is therefore not ranked, it is important as a denominator against which other financial data will be compared for ranking.

• growth: Since revenues and expenses can vary widely from season to season, growth is measured quarterly year over year, where the first quarter of this year is compared to the first quarter of the previous year, for example .

In the most recently reported quarter, amazon posted the highest year-over-year revenue growth by a significant degree, while liberty posted the least with lands’ end not far behind.

Because amazon’s earnings growth is not available, the metric will not be factored into the comparison. though it’s worth noting that the gains from freedom outweigh those from the end of the earth.

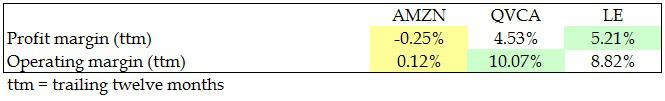

• Profitability: A company’s margins are important in determining how much profit the company generates from its sales. Operating margin indicates the percentage earned after operating costs, such as labor, materials, and overhead. profit margin indicates the remaining profit after operating costs plus all other costs, including debt, interest, taxes, and depreciation.

Of our three contestants, lands’ end had the largest profit margin while liberty had the largest operating margin. Amazon, meanwhile, competed on the tightest of margins, with negative profit margins indicating losses.

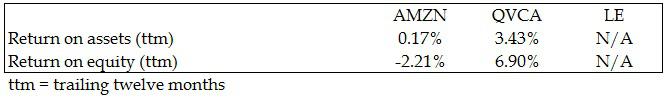

• management effectiveness: shareholders are very interested in management’s ability to do more with what it has been given. the effectiveness of management is measured by the returns generated by the assets under its control and by the capital invested in the company by the shareholders.

For your managerial performance, since returns on lands’ end assets and capital are not available, these metrics will not be factored into the comparison. though it’s worth noting that the liberty management team delivered higher returns on both assets and equity than the amazon team, with the latter losing some capital in the process.

• Earnings Per Share: Of all the metrics that measure a company’s earnings, earnings per share are probably the most meaningful to shareholders, as they represent the value the company adds to each share outstanding. Since the number of shares outstanding varies from company to company, I prefer to convert eps to a percentage of the current share price to better determine where an investment could fetch the most value.

of the three companies compared here, lands’ end offers common shareholders the highest diluted earnings per share as a percentage of their current share price, while amazon’s loss on share price is the lowest. lows and a negative reading here again. denotes loss.

• Share price value: Even if a company outperforms its peers on all of the above metrics, investors may still shy away from its stock if its price is already trading too high. this is where the stock price relative to future earnings and book value of the company is analyzed, as well as the stock price relative to earnings relative to earnings growth, known as the ratio of bonding. lower ratios indicate that the share price is currently trading lower than its peers and therefore could be a bargain.

Among our three combatants, each company’s stock is the cheapest relative to a different metric. At the overvalued end of the spectrum, Amazon stock is the most overvalued relative to future earnings and the company’s book value, while Liberty stock is the most overvalued relative to the 5-year peg.

b) analyst estimates and recommendations

Of course, no matter how savvy we may feel at evaluating a stock’s prospects as an investment, it would be wise to at least consider what professional analysts and the companies themselves are projecting, including estimated future earnings per share and the growth rate of those earnings, stock price targets, and buy/sell recommendations.

• Earnings Estimates: To properly compare estimated future earnings per share among various companies, we would need to convert them to a percentage of their current stock prices.

Of our three specimens, liberty offers the highest percentage of current quarter earnings over its current share price, while lands’ end offers the highest percentages over all other time periods. At the lower end of the scale, Amazon offers the lowest percentages of future earnings per share over the current stock price.

• Earnings Growth: For long-term investors, this metric is one of the most important to watch, as it indicates the percentage by which earnings are expected to increase or decrease compared to earnings. of the corresponding periods of the previous year.

For earnings growth, since lands’ end near-term projections are not available, these metrics will not be included in the comparison. however, for 2015 and beyond, amazon’s earnings are expected to far exceed those of its rivals, while lands’ end earnings are seen as slower overall.

• Price Targets: Like previous earnings estimates, a company’s stock price targets must also be converted to a percentage of its current price in order to properly compare multiple companies.

for their high, mid and low price targets over the next 12 months, analysts believe amazon stocks have the most upside potential and the most downside risk, while lands’ end stocks appear to reciprocate with the least upside potential and the least downside risk.

It should be noted, however, that both liberty and lands’ end shares are already trading below their minimum targets. while this may mean more potential for sharp moves to the upside, it may warrant reassessments of future expectations.

It should also be noted that lands’ end has a single broker who projects price expectations and selects a single target for all three categories. this data bias has no impact on the final ranking of the competition.

• Buy/Sell Recommendations: After all is said and done, perhaps the only indicator that sums it all up is analyst recommendations. these have been converted into the percentage of analysts recommending each level. however, I only consider strong buy and buy recommendations in ranking. hold, underperform, and sell recommendations are not ranked as they are determined after determining the winners of the strong buy and buy categories, and would only deny winners of their duly earned titles.

Of our three contenders, lands’ end is the best recommended with 0 strong buys and 1 buy representing a combined 100% from their 1 analyst, followed by liberty with 4 strong buy recommendations and 5 buys representing 90% of its 10 analysts, and, finally, amazon with 10 strong buy ratings and 19 buy ratings representing 65.91% of its 45 analysts.

here too, the apparent bias of the data due to unbalanced participation of analysts has no impact on the final ranking of the competition.

c) classifications

Having analyzed all the numbers and compared all the projections, the time has come to count the wins and losses and rank our three competitors against each other.

In the following table, you will find all the data considered above, plus some others that were not reviewed. This is where using a company’s market capitalization as the denominator comes into play, as much of the data in the table has been converted to a percentage of market capitalization for fair comparison.

The first and last placed company are shaded. then, we add the results of each company to determine its overall ranking; top places count as merits, while bottom places count as demerits.

and the winner is… lands’ end by a narrow lead, outperforming in 11 metrics and underperforming in 5 for a net score of +6, closely followed by liberty, outperforming in 8 metrics and underperforming on 4 for a net score of +4 and lastly by amazon upstream in the deep jungle, outperforming on 5 metrics and underperforming on 16 for a net score of -11. (canceling lands’ end price targets and recommendations wouldn’t have changed the final lineup, as it would have given it an even better score of +7, while keeping freedom in second place at +5; in case someone have an alternative). punctuation.)

where the catalog & The mail order house industry is expected to outperform the broader s&p market substantially this and coming quarters, significantly in 2015 and significantly beyond, the three largest us companies. uu. Companies in the space are expected to split the performance, with amazon’s earnings shrinking in the immediate term, then rising in 2015, liberty’s earnings outperforming the broader market for the most part, with lands’ earnings end barely growing in 2015 before increasing in the next five years.

however, after taking into account all company fundamentals, lands’ end ranks first among its peers due to its lower stock price to future earnings, lower debt to market capitalization , highest current ratio, highest earnings over market cap, highest profit margin, highest overall future earnings over current stock price, with or without price target, and analyst recommendation ratings , narrowly winning the catalog & amp; mail order house contest.