what is the 940 model?

Form 940, the Employer’s Annual Federal Unemployment Tax Return, is an IRS form that employers use to report any futa tax payments they have made during the course of the calendar year, as well as any outstanding futa payments that they have not yet done. .

futa stands for federal unemployment tax law. it is a tax paid by companies; Unlike Medicare, it is not deducted from employees’ wages. The futa tax helps cover the cost of unemployment compensation and state employment agencies. the futa tax rate is 6.0% and applies to the first $7,000 each of your employees earn.

The actual amount you end up paying could end up being much less than 6.0%, depending on your state’s individual futa tax credit; in many states, you’ll only end up paying 0.6%.

Form 940 is different from a similar tax form, Form 941. Form 941 is the employer’s quarterly federal income tax return, which employers use to report payroll taxes (such as social security tax). , federal income tax and medicare) withheld from employees. ‘ paychecks.

To learn more about futa payments and how to make them, check out our futa guide.

Do I have to present the 940 model?

according to the irs, you must make futa payments and file form 940 if any of these are true:

- paid wages of $1,500 or more to employees during the calendar year.

- had at least one employee for at least part of the day in 20 or more different weeks. (All full-time, part-time, and temporary employees count, and do not need to have worked a full business day to count.)

If you only work with independent contractors, you don’t need to worry about filing Form 940 since you don’t pay unemployment taxes on your earnings. instead, you are responsible for filing the 1099-nec form for each contractor.

When do I present the 940 model?

Unlike your futa payments, which are due each calendar quarter, you must file Form 940 annually.

The due date to file Form 940 for 2021 is January 31, 2022. (However, if you are current on all your futa payments, you can take an additional ten days and file Form 940 by January 10, 2022.) February 2022.)

how the bank can help

The 940 filing deadline is one of many tax filing deadlines that can make for a stressful start to the year. It’s easy to start feeling overwhelmed with all your tax filing responsibilities as a business. but with a bank, the process is simplified. We give you all the information you need to file a business tax return, file 1099s, and more. Or, if you’re a completely hands-off type of person, we can even do your taxes for you. We can’t handle your payroll tax, but we can buy you back the time it takes to do so. learn more.

how to fill in form 940

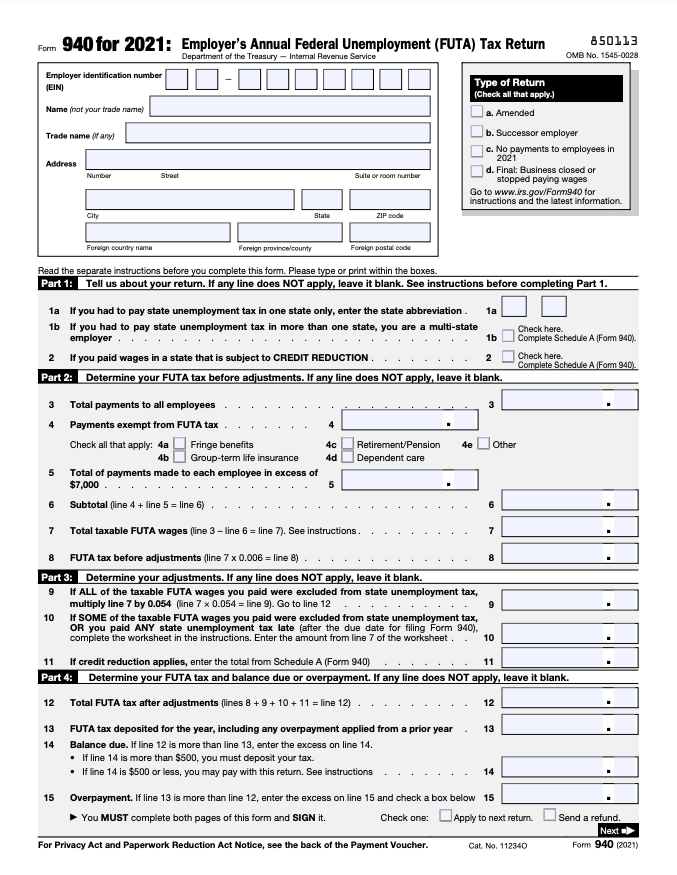

form 940 is a 2 page irs form. this is what the first page looks like:

First, you need to fill in some basic information about your business. This includes your employer identification number (EIN), business name, trade name (or DBA), and address. note that you cannot use a different tax identification number (tin) in place of an ein as a social security number.

After that, Form 940 is divided into seven parts.

part 1

this is where you tell the irs in how many different states you pay unemployment taxes. line 1a is where you’ll specify if you pay unemployment taxes in a single state, line 1b is for multistate employers, and line 2 is where you’ll specify if works in a credit reduction state. if you check the boxes on line 1b or 2, complete schedule a of form 940.

part 2

This is where you will calculate your futa tax liability. line 3 will ask for all payments you made to employees, line 4 will ask for any futa-exempt payments (such as fringe benefits, group life insurance to term, etc.) .), while lines 6 through 8 are where you’ll calculate your total taxable futa wages and total futa taxes before adjustments.

part 3

Here you’ll make adjustments that take into account your state’s unemployment tax rules. If all of the futa wages you reported in the previous section were excluded from state unemployment tax, multiply line 7 by 0.054, enter it on line 9, and go to part 4. if they were not, use the worksheet on page 11 of this instruction booklet to calculate your adjustments.

part 4

line 12 will ask you to add lines 8 + 9 + 10 + 11 to calculate your total futa tax after adjustments. line 13 will ask you for the futa payments (or overpayments) you have made so far or in the previous year. lines 14 and 15 determine if you have an outstanding balance due (or overpaid charges).

part 5

If the amount you calculated on line 12 is more than $500, use boxes 16a-d to report your future obligation for each quarter. (note: each box should list your responsibility for that quarter, not your quarterly payment). make sure these all add up to what you had on line 12.

part 6

This is where you will designate someone (an employee or tax preparer) to discuss Form 940 with the IRS on your behalf.

part 7

Once you have completed Form 940, sign your name here.

payment voucher

If you end up with any futa tax due, you’ll need to include proof of payment with your 940, which you can find on page 3 of the pdf version of form 940 provided by the irs. enter your employer identification number (ein), total payment amount, business name, and address before submitting.

Where to file form 940 (and can it be filed electronically?)

Although you can file a physical copy of Form 940, the IRS prefers that you file it electronically.

If you file a paper return, where you file depends on whether you include a payment with Form 940. To find out where to mail your physical Form 940, see this table provided by the IRS.

To file electronically, follow the instructions on the IRS website.