Scammers are always looking for an opportunity to make a quick buck, and tax season is full of scammers looking to trick people into handing over money. It’s essential to be vigilant when you receive a communication from the Internal Revenue Service (IRS) because a letter or call from the “government” may not be all that it seems.

Here are some tips to spot a fake IRS letter and protect yourself and your business from tax scams.

why are mail order scams so deceptive?

if you get an unexpected phone call from “the irs”, you should hang up immediately. The IRS never calls, texts, or emails taxpayers to notify them of a problem, and they definitely won’t message you on social media either. you will always get a letter first.

However, financial criminals know their cards and do their best to mimic the government agency. if they can get you to call, email, or go to a website, they’ll do everything they can to part you with your hard-earned money.

if you get a letter saying it’s from the irs, stay calm: it very likely is. however, before you act, take steps to authenticate it. You can search for the subject or similar letters on irs.gov, where you can find enough information to verify the letter or resolve the issue on your own.

If the letter looks legitimate, but you still have questions or concerns, you can contact the IRS using one of their public phone numbers, so you know you’re really talking to the IRS.

what does a real irs letter look like?

The IRS sends letters for many common reasons. IRS letters almost always arrive before any other form of contact and are sent by regular US mail. postal service mail.

Of course, if you don’t follow up as required, the IRS may contact you by other means, but that’s less common.

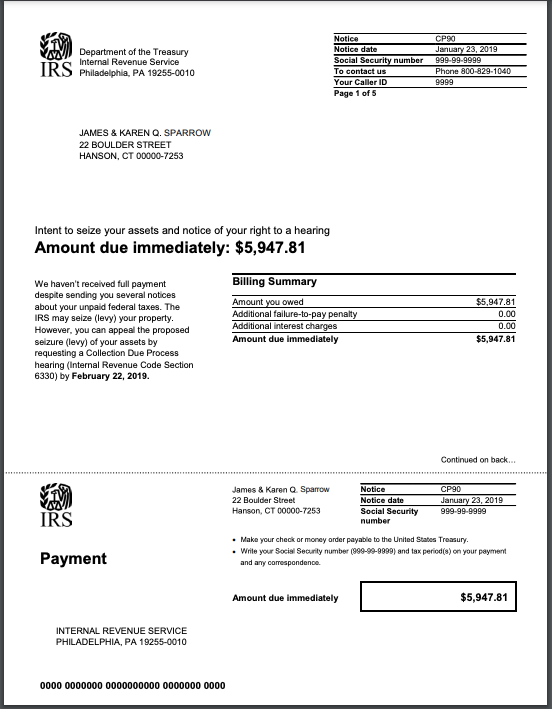

Above is an example of a legitimate irs letter. note the notice number at the top right.

Most irs letters are called “notice” and always contain the irs logo. you may receive several letters or notices about the same problem. The letter must clearly explain why we contacted you and what you must do in response. the letters always include your rights as a taxpayer. It will also typically include your truncated tax identification number or social security number and list a specific tax year.

here are some common reasons the irs may contact you:

- you or your business owe a balance

- the amount of your refund or payment was incorrect on your tax return

- the irs changed your tax return

- the irs has questions about your previous tax return

- the irs needs to verify your identity or collect additional information

- there will be a delay in processing your tax return

Actual irs notices contain a notice number (cp) or letter number (ltr) in the upper or lower right corner of the page. You can search for that type of notice on the IRS website for specific information to help guide your next steps.

if you receive any correspondence from the irs, you should keep a copy of the letter on file until the problem is fully resolved. To be on the safe side, the IRS recommends keeping tax records for a minimum of seven years in some cases.

9 ways to spot a fake irs letter

If a fake IRS letter shows up in your mailbox, here’s how to spot an impostor and how to respond.

1. notice about a tax return you have not yet filed

many scam letters are sent early in the year when they know people are busy filing. If you receive a letter for a current tax return that you have not yet filed, it is clearly a forgery.

2. the irs logo is missing

irs always includes the irs logo. if it’s just text with no logo, it’s not a real irs letter.

3. spelling and grammatical errors

Your letters always use correct spelling, capitalization, grammar, punctuation, and formatting.

4. immediate payment demand

Government letters requesting payment never say you must pay immediately. bogus letters from the irs often include high-pressure language demanding that you pay immediately.

5. anything related to gift cards or irregular payment methods

the irs doesn’t want prepaid cards, itunes gift cards or anything but good old fashioned US dollars. you must use a bank account, debit card, credit card, or check for payment.

6. note that you have won something

the irs does not give money. His job is collections. there are no prizes or winnings.

7. threats of jail or prison time

The Internal Revenue Service will not send threatening letters saying you will go to prison or jail if you don’t pay your taxes. while this is technically true, jail time threats are not included in their emails.

8. request for payment to anyone other than the us uu. treasury

Payments are only made through official IRS channels, including the IRS website and authorized payment providers. If you pay by check, it must be made payable to the US. uu. treasury. a payment request in any other way is not legitimate.

9. does not arrive in an official government envelope

irs mail comes in official government envelopes with the irs logo. If you receive a plain envelope or something suspicious looking, it’s probably a fake letter.

You can learn about the latest widespread tax scams with the IRS Dirty Dozen Annual Report.

how to report a fake irs letter

If a bogus letter from the IRS arrives in your mailbox, you can take action to fight scammers by reporting the letter to the government. this helps them track patterns, hunt down the criminal, and offer better advice to protect others.

The official place to report fraudulent letters is the Treasury Inspector General for Tax Administration (TIGTA). you can also scan and email a copy directly to the irs at phishing@irs.gov.

what to do if your irs letter is real

if your irs letter is real, don’t ignore it. Late and inaccurate taxes can lead to penalties, interest, and worse. when you believe the letter is accurate, you can follow the instructions in the notice to resolve the notice. If you disagree with the notice or think something is wrong, you have the right to appeal.

Small businesses with a trusted accountant, tax professional, or tax attorney should contact them for advice. You can resolve disputes with the IRS on your own. Still, many businesses benefit from the help of an experienced tax professional with the knowledge to help minimize tax liabilities and penalties.

how the bank can help

The IRS does not typically send letters to taxpayers or businesses with a history of accurate and timely tax returns. problems arise when you have bookkeeping problems and make mistakes when putting together your tax return. bench can solve those two problems before they happen.

bench offers specialized accounting and tax services for small businesses, including historical accounting to update your books the right way. your bank team knows where to look for deductions and credits you may have overlooked. bench offers complete tax preparation and filing for you for the current and future years.

If you end up with a letter from the IRS and need additional support, bank customers have access to a network of partners to handle anything the IRS sends them. Learn more about what the bank tax return looks like.

don’t be a victim of a fake letter from the irs

an irs scam can target anyone. While most are filed during tax season, it’s crucial to be aware of potential fraudulent letters throughout the year. If you find something suspicious, it’s always best to contact the IRS directly using a publicly available phone number to confirm it’s real.

To ensure your tax returns run smoothly from now on, consider working with a bank for your bookkeeping, bookkeeping, and tax needs. With a trusted bookkeeper on your team, you can stop worrying about taxes and focus your attention where it belongs: running a successful business.