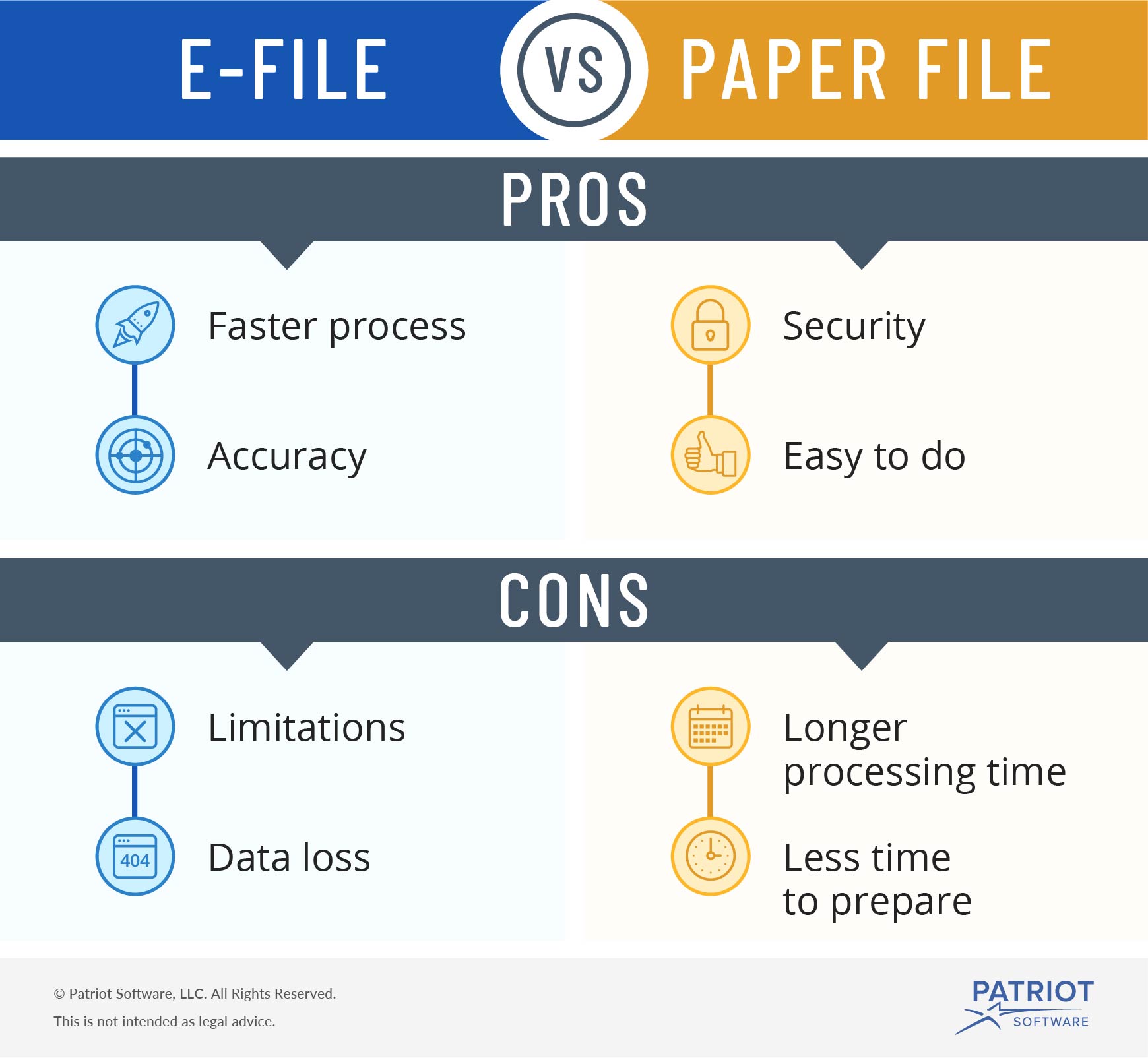

In this digital age, it may seem surprising that there is the option to file a paper tax return. But before you dismiss the idea of paper filing, consider the advantages and disadvantages of electronic filing vs. paper filing below.

electronic file versus paper file

e-filing, or electronic filing, is the process of filing tax returns over the internet. paper filing, on the other hand, is mailing tax returns.

Individuals must choose between electronic filing or mail to file form 1040, usa. uu. personal income tax return. Form 1040 is normally due on April 15 of each year.

Businesses must file a business tax return along with their individual tax return. Make sure you submit the correct forms, which depend on your business structure. and be aware of the due date on your business tax return.

advantages of electronic filing

Consider the benefits of electronic filing below.

faster process

The last thing you want to do is spend days or weeks going through paperwork to file your taxes.

According to one source, the IRS typically processes e-filed returns in a day or two, whereas filing a paper return takes much longer.

Because e-filing reduces processing time, individuals and businesses receive refunds more quickly (for example, three weeks after e-filing). And the IRS instantly sends a confirmation when it receives an electronically filed tax return.

precision

Your tax return must be accurate. Online e-filing does the math for you, leaving less room for error. You may also choose to use a computer program or software to file electronically. most computer software will catch any data entry errors before completing the e-filing process.

If there is an error, electronic returns tend to be easier to correct as well.

disadvantages of electronic filing

See some of the reasons you can choose not to e-file.

limitations

Filing taxes electronically is not for everyone. Although convenient, there are some limitations to electronic filing.

For individual tax returns, you cannot use the e-file application if:

- you need to add declarations or other attachments (for example, pdf attachments)

- you are filing decedent declarations

- the “additional information” section on your form does not contain enough space

- your submission before e-filing begins (January 28) or after e-filing ends (October 20)

visit the irs website for additional details on e-filing limitations.

data loss

Electronic filing has the advantages of secure storage and regular backups. however, the technology is not perfect.

The possibility of losing data is a risk you take with electronic filing. consider what would happen to your information if your system, computer or hard drive fails. could you replace your information? Will you have the historical documents you need to prepare for the upcoming fiscal years?

advantages of filing on paper

Review some advantages of paper filing before choosing between electronic filing or paper filing.

security

Although filing electronically may seem like a simpler process, filing on paper may have fewer potential security risks than filing electronically.

Paper filing allows you to avoid entering personal information online. Information like your name, address, and social security number could be at risk when you e-file.

Paper filing allows you to avoid electronic storage of tax information. and can help prevent information from falling into the wrong hands (eg, identity theft).

easy to do

Unlike filing electronically, filing on paper does not require the use of technology. some find it easier to fill out a form in person rather than trying to enter information into a computer.

If you prefer to use pen and paper or are not tech-savvy, filing on paper may be a better option.

disadvantages of filing on paper

Consider the disadvantages below before deciding to file on paper.

longer processing time

Because the paper filing requires mailing, it may take longer to process.

Unlike filing electronically, which takes a few days to process, paper files can take weeks to fully process. and, individuals may have to wait up to six weeks to receive their refund after filing their taxes.

less time to prepare

Consider the amount of time it takes to prepare and file your tax return when deciding whether or not to file on paper. if you wait too long, you may miss the deadline and incur charges.

Please allow enough time when you apply to avoid late fees. for example, you could start the process two months before the deadline.

Need to organize your records before your tax return is due? Update your books and reduce the stress of the tax filing process by using Patriot’s online accounting software to record transactions. try it for free today!

This is not intended as legal advice; for more information, click here.